I haven’t seen many new, extremely compelling deep values since my last post on American Outdoor Brands (AOUT). I have seen a continued trend in small-cap pharmaceuticals to get industry rotation. So, I have been hunkering down on finding pharma stocks below net cash. In-part, I see this pharma theme as a lower rates trend, in addition to my original thesis on improved technology industry-wide.

It turns out, I was on to something and just early again like with the clean energy theme. I’ll touch on pharma more after CarParts.com.

CarParts.com PRTS

One of the best deep value candidates is currently Carparts.com (PRTS). Carparts.com is one of the major players in car parts e-commerce. They own the iconic brand JCWhitney, which they acquired in 2010 for $27 million, when their name was US Auto Parts.

A long time ago I used to buy auto parts from auto repair shops and after learning of the significant markup, I switched to strictly buying parts online. Buying online is almost always atleast half the price of repair shops and dealerships, and can be even 3X+ cheaper.

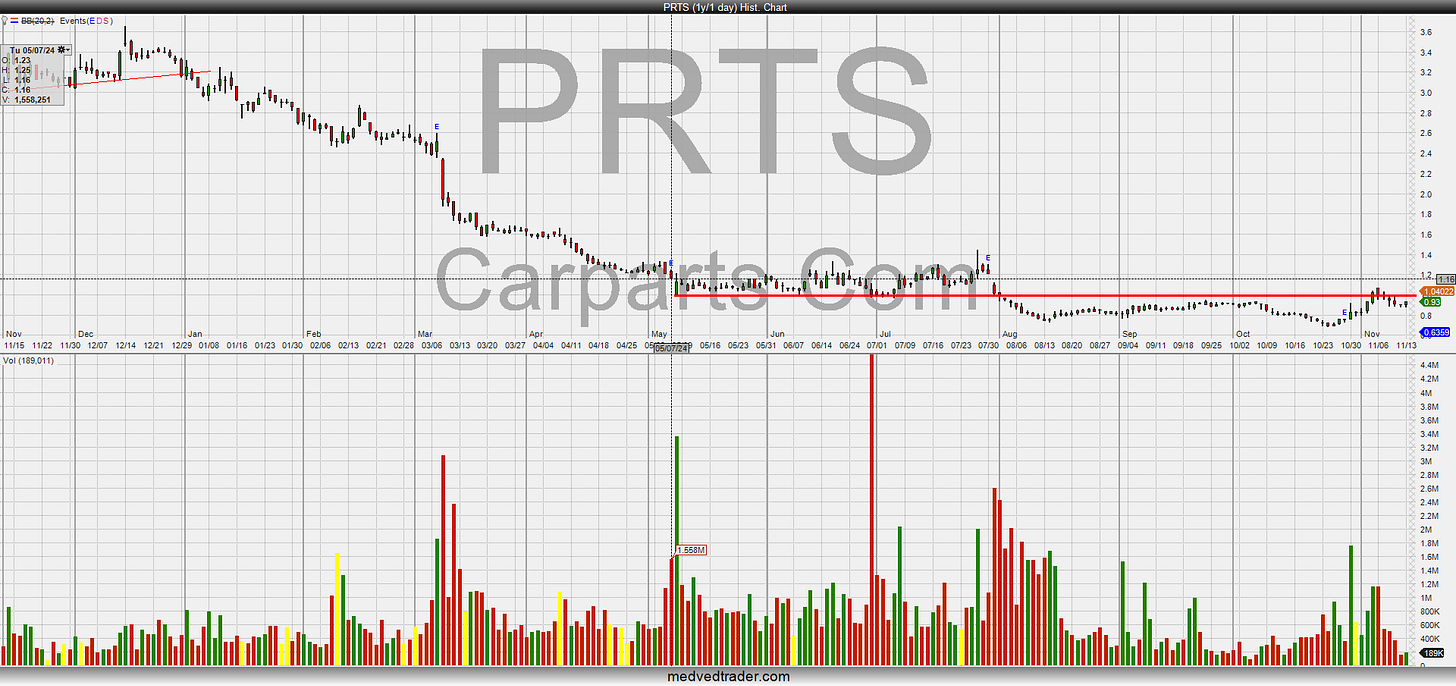

They reported earnings the end of October, and the stock has reacted positively and is still up 25% since. I read the conference call transcript to get the big picture.

PRTS has a $53 million market cap, with the stock currently at $.93 a share. Net tangible asset value is $54 million. Cash is 25% of NCAV (net current asset value). The current ratio is healthy at 1.5. Other than their leases there is zero long-term debt.

Positives

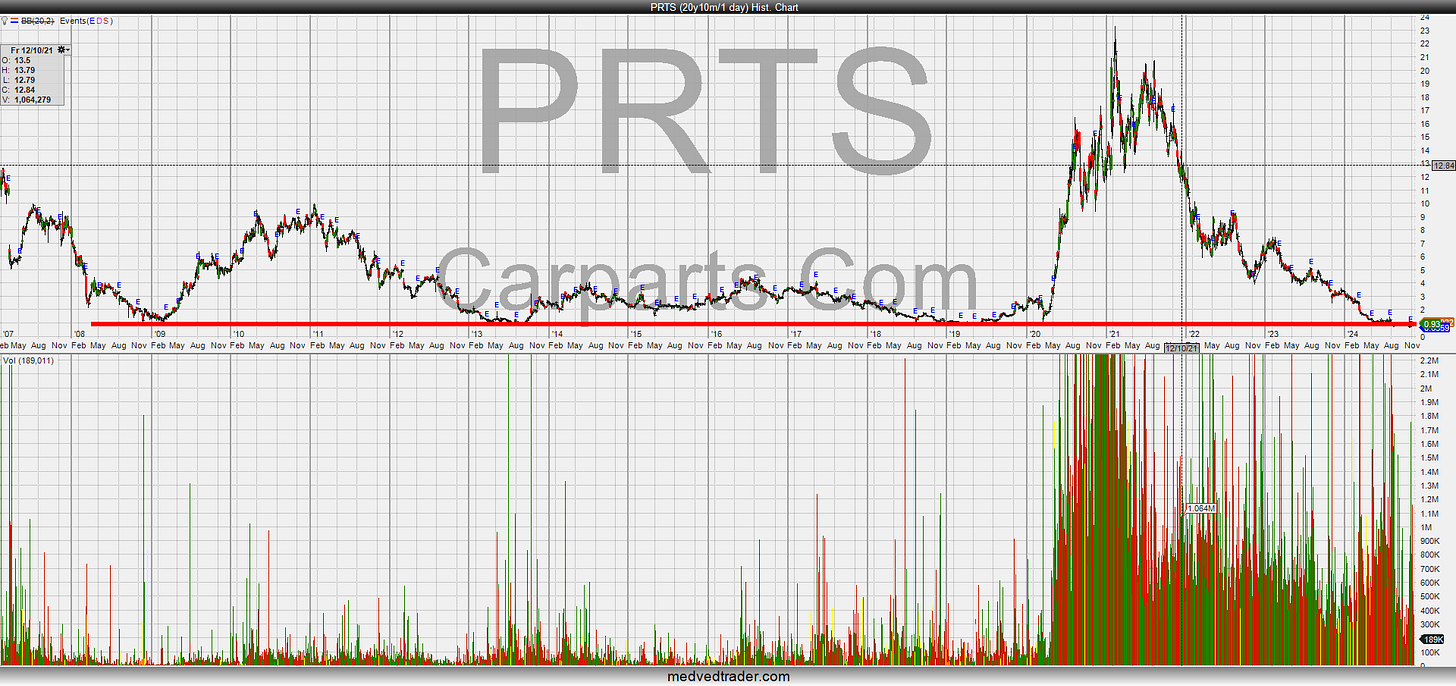

One of the good things the company has in its favor is it is far from a perennial deep value. The stock was up 2,300% from 2019-2021. David Meniane was CFO back then, and is now the current CEO.

Sales grew +13% in 2022 which shows durability during a consumer spending slump.

In the most recent quarter, gross margin increased to 35.2%, up from 32.9% year over year. This 35% gross margin is in-line with historical gross margin.

In the recent conference call the CEO said that this past quarter was the first time ever that Q3 sales were higher than Q2 in the same year.

With an ability to generate sales growth, the current price-to-sales ratio of .09 is incredibly cheap. TTM sales are $611 million and the company is guiding this years sales at $600 million as stated in the most recent conference call.

Conference Call Highlights

Some interesting commentary from CEO David when asked about the quarter, “I think a lot of it is just inventory-driven, pricing actions, some of the marketing initiatives, the new website, it's just relentless execution across the board.

“The mobile app is probably one of the best evidence points to look at. We launched it last year. We're now up to 550,000 organic downloads. And if you unpack the numbers of the mobile app, you have, call it, 8% of revenue.”

I’m pretty shocked they didn’t have a mobile app in this day and age. If this is the case they must be missing a lot of the younger demographic. In theory, this could help a great deal with the younger demographic who only use mobile.

Negatives

Some things I don’t like about it are the recent slowing sales growth and weak EPS trend. They have grown sales consistently well over the past few years but growth has slowed this year and was down -13% YOY in the most recent quarter. The past few years, they haven’t been able to get profitable.

Final Thought

I’d like to see a sign of price bottom and momentum switch in the stock to consider a long. They talked about improving free cash flow going forward in the recent call and I just want to see that the market believes it. $1.00-$1.07 a share (red line) is the hurdle it needs to break over.

I zoomed out and going back to 2009 the share price floor has been in the $.90-$1.00 range. It found support at this share price level (red line) in 2009, 2013 and again in 2019.

Pharma Stocks

I have been trading some trending themes in small-cap pharma, among other themes like energy storage, medical device and AI/robotics etc. Most of these stocks I have posted on my X.com account.

I wanted to share some quick updates on the cash rich pharmaceuticals I have written on or like now.

I found Aclaris Therapeutics (ACRS) well below net cash many months ago but hesitated to share this one here. I didn’t want to make this Substack overly about small-cap biotech/pharma stocks which historically are extremely challenging.

ACRS business is in conducting small molecule drug discovery and preclinical development research through KINect, their proprietary drug discovery platform. The KINect platform enables them to identify potential drug candidates through a unique combination of our proprietary chemical library of kinase inhibitors, novel approaches to inhibitor modalities.

They have a couple drugs in the pipeline, and revenue has been growing the past couple years. Net cash and securities is $122 million and with the stock at $2.44, the market cap is $174 million. Seer (SEER) continues to uptrend also.

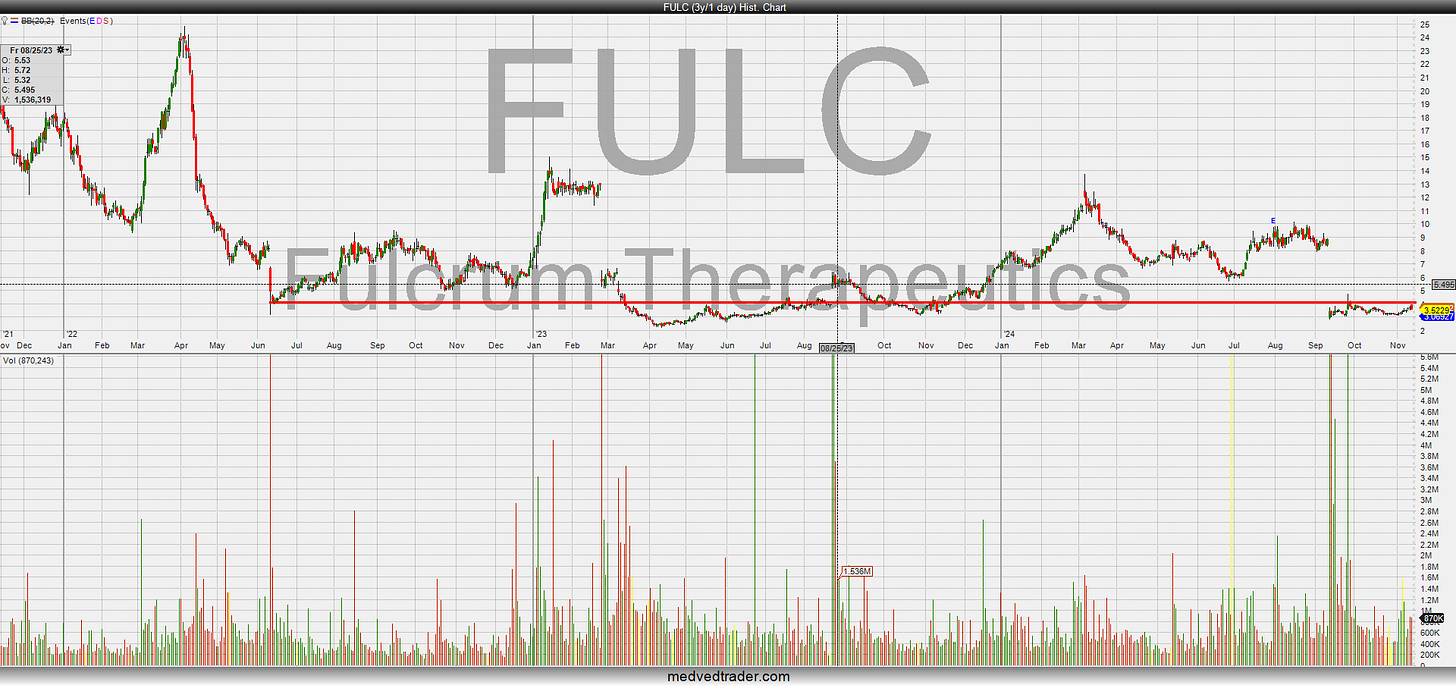

A new net cash stock I found is Fulcrum Therapeutics (FULC). It has $4.05 a share in net cash and securities (cash and securities less total liabilities) and currently trades for $3.65 a share. Latest quarterly earnings came out yesterday, and the stock price reaction still seems undecided. The $3.00 a share level has been roughly the floor for the stock the past three years. You can see the major internal level with the red line below.

If you read my old post from early June of this year on several stocks , including the energy companies in deep value land, you may remember Laird Superfood LSF. Laird Superfood stock ran from $4 a share at the time of that post to a recent high of over $10 a share or a 150% return in about five months.

I’m not bringing this one up to show off, rather to simply show how micro and small-cap stocks selected well can really juice an already diversified portfolio.

Disclosure: I am long SEER ACRS LSF AOUT

Hey Mark-

I have watched PRTS for a while. It is taking a dive below what I thought was a rough technical bottom so i may wait for dust to settle. Given the news of strategic review, do you anticipate a positive outcome here? I worry about cash burn a bit, i also wonder what could be an acquirers multiple here. Thoughts?

The strategic options could sure be good. You never know though if anything comes from it when these get announced. I don't know enough about the competition to guess a multiple or anything. Sorry. Wish I had more insight here.