My usual bottom-up approach to finding value stocks is a regular stock screener, looking for balance sheet strength and other fundamental metrics. I also run technical scans for momentum every night, that focus on lower priced stocks less than $12 a share. Sometimes, the technical bottoms or high day range and momentum lead me to take a peek at the fundamentals. Years ago, I found Carparts (PRTS) in such a way. I found it back in 2019 from the chart. It was a net tangible asset value, or near NTAV. I mention this to share that I have an active Twitter/X account where I post a lot of trading setups, thoughts, and research.

I posted the Carparts (PRTS) in summer of 2019 on my Twitter. The stock then ran 1,500% by 2021.

PRTS had just bought the CarParts.com domain name back then, and everything aligned perfectly for that stock run. I still keep an eye on it from time to time, and it is back below net tangible asset value again. I don’t see the same scenario now as then, especially with the stock continuing to downtrend. It’s almost half of net tangible assets now.

I found Laird Superfood (LSF) in similar fashion a month ago. It wasn’t a deep value but had good fundamentals.

Laird was as simple a play as major improved gross margins on a small-cap company and a turn to positive FCF. Like Peter Lynch would say, “I have to be able to draw it in crayon.” It is up 85% from my Twitter alert.

This Substack is for strictly deep values in the range of net cash, net current asset or net tangible asset value. I do include the technical analysis just as another tool. I don’t believe these stocks always have to have technicals to perform. The success of these deep value portfolios in history from the firms that practiced the approach were from buy and hold. Investors like Ben Graham, Walter Schloss, Buffet etc. had success with deep value. I definitely believe a diversified portfolio helps with the volatility of small-caps which these kind of stocks usually are.

I would say there is “edge” in using technical levels and momentum patterns on these stocks because they are usually so small. I always suspected most of the value investors wouldn’t use any technicals at all on these type of stocks.

When I started blogging in 2006 about these stocks people would say there weren’t any other public blogs or articles that looked at deep value investing that used technical analysis.

On To The Value Plays

In this article, I am going to share some analysis on some deep value stocks that are well capitalized and could participate in a new sector rotation. Before I go into the stocks, I want to paint the backdrop of what has been happening with utility stocks and the sustainable clean energy theme.

One of the recent themes that continues in the U.S. equity markets is the buildup of datacenter infrastructure to power big tech companies LLMs(large language models) or artificial intelligence models. Nvidia (NVDA) stock is hitting new highs over $1,200 a share as I am writing this. There has been a major pull-back in many tech names, especially cloud related. However, the AI capex is actually growing with all of big tech. Big Tech will probably do upwards of $200-210 billion combined in capex this year, predominantly for AI infrastructure.

Microsoft (MSFT) is unable to keep up with demand for Azure’s AI services and is raising capex 50% for this year. They increased capex 90% in Q1 and are looking to triple their GPU supply this year! It’s the same buildup story with the others like Amazon (AMZN), Alphabet (GOOGL) and Meta Platforms (META). Elon Musk and his new company X.ai just a couple weeks ago received $6 billion in funding and are ramping up GPU spending.

The point is more data centers means more electricity is needed. The AI LLM model prompts and queries like those in Chat GPT-4 and Perplexity.ai (Google search competitor) use 10 times as much electricity as a Google search. Personally, I am an early adopter of LLMs for workflow and internet search. I’ve been using Microsoft Copilot AI and Perplexity.ai since early 2023. They are both free and speed up internet searching.

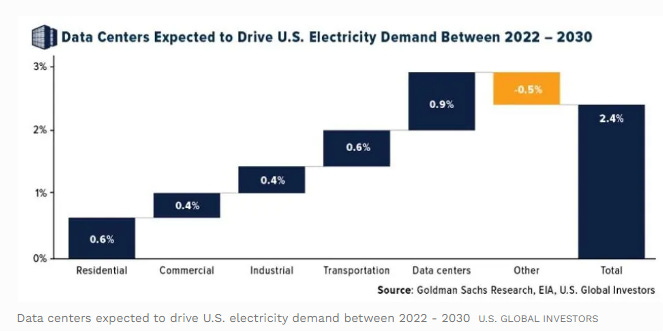

The Electric Power Research Institute says that data centers could consume 9% of the United States’ electricity generation by 2030. Goldman Sachs forecasts datacenter growth to outpace all others the next six years as the image below shows. As we have seen in history, tech trends can accelerate quickly. From personal computers in the 80s, to internet in the 90s these trends can grow faster than many expected.

As more and more devices and companies begin using AI models it could be an unexpected impact on electricity demand. Utility stocks via the Utilities Sector SPDR ETF (XLU) are up 13% this year. Some of the biggest winners are the companies in the biggest data center states like Virginia and Texas.

The other part of this backdrop is the clean energy movement. The clean and alternative energy movement has been in motion for years. However, it has never really gotten sustained traction. It seems to have been getting more attention from investors in the last few years and may be ramping up. Just a month ago news came out on Blackrock’s Decarbonization Partners, a partnership between BlackRock and Singaporean state investment firm Temasek. They raised a higher-than-targeted $1.4 billion for their first climate tech fund. Link below

BlackRock-Backed $1.4 Billion Fund Proves There's Cash to Make In Climate Tech

One of BlackRock’s infrastructure funds invested $550 million in a project called STRATOS, which will be the world’s largest direct air capture facility when construction is completed in 2025. Deep value FuelCell Energy (FCEL) also has a carbon capture business segment. Blackrock’s CEO has written about his energy infrastructure vision in his letter to shareholders. He lays out the need and economics of the energy pragmatism strategy. click below

I believe the recent focus on energy in the stock market from datacenters and utilities could be the spark that gets investment rotating into alternative energy. News can be nothing more than “noise” sometimes when it comes to the actual stocks themselves. However, the move in First Solar (FSLR) one of the major solar companies is signal not noise. The stock is up 60% this year and is flying off of it’s most recent earnings report.

Analysts with UBS expect First Solar's earnings could triple from $7.74 per share last year to $36.74 by 2027, helped by AI. Tech companies such as Amazon, Microsoft, Alphabet and Meta have committed to purchasing renewable power equal to their consumption of electricity. That means solar can help pick up the demand created by AI data centers, according to the report.

"FSLR's unique technology is ideally situated for two of the largest ongoing structural themes: AI driven electricity demand growth and increasing U.S. protectionism," UBS analyst Jon Windham wrote to clients.”

Another clear sign is Brookfield Renewable Corporation (BEPC) news on working with Microsoft on renewable energy. Brookfield stock soared for days in early May right after the announcement. The agreement between Brookfield and Microsoft is rooted in the two companies’ shared goals to decarbonize global energy supplies and reduce carbon emissions.

The agreement provides a pathway for Brookfield to deliver over 10.5 gigawatts of new renewable energy capacity between 2026 and 2030 in the U.S. and Europe.

On to Deep Value Origin Materials (ORGN)

The first value stock I want to mention today is Origin Materials (ORGN). Origin is a leading carbon negative materials company. Origin has developed multiple sustainable and performance-enhanced solutions for improving recycling and circularity, including its all-PET caps and closures, as well as low-carbon material solutions.

I get all the company numbers I look at straight from their SEC filings at SEC.gov. Many times there are discrepancies between finance websites and the official filings.

ORGN has net current asset value of $136 million. I got this figure by taking total current assets of $176 mil and subtracting total liabilities of $40 mil. That includes all long-term debt. A large sum of working capital is cash and securities. $146 million is in cash and marketable securities. The company is very well capitalized with a current ratio of a whopping 12.5. Cash on the balance sheet increased slightly in the recent quarter by $200k.

Deep Value Territory

Origin net tangible asset value is $374 million.

The current market cap of the company with the stock currently at $1.06 is $155 million. So, we are just above net current asset value and 59% below net tangible asset value.

Origin has a proprietary biomass conversion platform to convert biomass, or plant-based carbon into building block chemicals chloromethylfurfural and hydrothermal carbon.

The most immediately promising thing about this company to me is their bottle caps business. The bottle caps market is huge and in the billions. The Origin bottle caps are a mono-material that makes “100% recycled PET” possible from cap to bottle and improves recyclability because it is all one material, without the need for recyclers to separate caps from bottles.

They put out a press release about a month ago with these highlights.

“Reaffirms Pathway to Profitability Led by Caps & Closures, No Additional Equity Capital Required”

“Over the quarter, we have seen strong progress on our pathway to profitability, led by our groundbreaking PET caps and closures business,” said Rich Riley, Co-Chief Executive Officer of Origin. “We announced a few of our caps and closures manufacturing partners including PackSys Global and IMDvista, and we continued to make excellent progress with prospective and as yet unannounced customers who are excited about our revolutionary caps offering and the benefits it brings for recycling circularity and performance. In addition, today we are announcing that we have accelerated the procurement of multiple additional high-throughput commercial production lines to complement the first line, which we already ordered. We aim to bring our first manufacturing system online during the fourth quarter 2024. At full capacity, our initial systems are expected to generate between $45 million and $65 million in annual revenue.”

They just started recording revenue last year and it was $28 million from the biomass manufacturing plant. For this year they expect revenue of $25 million to $35 million. Net cash burn between $55 million and $65 million.

Institutional Holders

About 28% of the shares are held by institutions. Blackrock and Vanguard Group are the first and second largest holders of the stock.

There appears to only be one analyst covering this stock which is often a good thing for being under the radar.

Technical Analysis

The stock is as beaten down as any other small-cap name. It found support this year at about $.50 a share and has had some unusually big blocks of shares come in since April as it is trying to form a long base. Trend support (blue line) is still holding. To truly be a technical bottom it needs to break over $1.25-$1.27. The chart is much like the Solar ETF (TAN) and atleast has relative strength and a recent uptrend.

Second Deep Value FuelCell Energy (FCEL)

FuelCell Energy has $687 million in net tangible asset value and a $429 million market cap. So, we are at a 38% discount to net tangible assets.

FCEL has $297 million in cash on the balance sheet. Current ratio is 8.2. Cash increased by $48 million quarter over quarter.

They grew revenue well from 2020 to 2022. Revenue grew 88% for 2022, then down -5% in 2023.

The company describes themselves as helping to deliver a more sustainable future by decarbonizing power and producing hydrogen around the world. Our platforms can help businesses and communities with power generation, carbon capture, hydrogen production, and energy storage.

On their website they advertise fuel cells for datacenters as a power back-up. The carbon capture is particularly interesting based on what I have been reading about with Blackrock’s recent investments. It seems this has some traction.

In May 2023, the Company entered into a second letter agreement with ExxonMobil Technology and Engineering Company (formerly known as ExxonMobil Research and Engineering Company) (“EMTEC”), pursuant to which the parties agreed that the conditions to the Company’s agreement to invest in the future demonstration of the technology for capturing carbon at an ExxonMobil refinery located in Rotterdam, Netherlands.

On January 31, 2024, the Company received a purchase order valued at $11.6 million from Esso Nederland B.V. (“Esso”), an affiliate of Exxon Mobil Corporation and EMTEC, for fuel cell modules as well as engineering, procurement, fabrication, testing and delivery services required for the construction and implementation of the modular point source carbon capture pilot plant.

Another development is they are working with Toyota Motor. Thanks to FuelCell Energy’s Tri-gen platform, TLS Long Beach is Toyota’s first port vehicle processing facility powered by 100 percent on-site generated renewable electricity. FuelCell Energy’s innovative fuel cell technology uses an electrochemical process that converts directed renewable biogas into electricity, hydrogen, and usable water with a highly efficient, combustion-free process that emits virtually no air pollutants.

Institutional Holders

The top two largest holders are Vanguard Group and Blackrock. About 45% of the company stock is held by institutions.

Analyst Coverage

There are about 7 or 8 analysts currently on the stock. This stock has been in play in the past. It had a huge run in late 2020.

Technical Analysis

Unlike the other stocks I mention today this one is technically not showing any support levels holding or downward momentum breaks. The volume in May was high and the triangle pattern it is finishing right at a major level from last year is a potential bullish setup. The stock has to hit $1.03 over previous resistance to actually bottom.

Freyr Battery (FREY)

Freyr is incorporated in Delaware, USA. Freyr aims to provide industrial scale clean battery solutions. They are building factories in Norway and have a potential development of industrial scale battery production in the U.S. They are building their first battery cell manufacturing project in the U.S. (“Giga America”), which is located on a 368-acre parcel of land in Coweta County, Georgia that was purchased by the Company in 2022. They are also building in Norway.

Freyr has $535 mil in net tangible asset value. The market cap is $328 million. The company is trading at a 39% discount to NTAV. Of the $268 mil in current assets $249 is in cash and cash equivalents. Current ratio is 3.0. Cash decreased quarter over quarter by about $4 mil. The company has no revenue right now and fundamentally is my least favorite of all these just because of that. The compelling things are the low valuation, industry and strengthening technicals. I think it’s atleast a shorter term trade because of the momentum.

Institutional Holders

35-43% of the shares are held by institutions with Encompass Capital Advisors, LLC a small hedge fund holding the most stock with 9% of the shares. I couldn’t find any information on the second largest holder Kim LLC. Invesco is the third largest holder with 2%. Long Focus Capital Management, LLC is another small hedge fund with 1.75%. Atleast one more hedge fund has a position.

Technical Analysis

The technicals on this one are the best out of the three at the moment with a clear bull flag formed on a test of the major level around 2.20. This former resistance level appears to be turning into support along with trend support holding (blue line). It’s a bull flag because selling volume is light and decreasing day after day on the consolidation days since 5/24 spike. It’s also formed a long base since Q4 23.

Disclosure: I am long FuelCell monthly call options and may buy shares or calls in FREY and ORGN.