In the past, I always had a negative bias toward biotech and medical stocks when screening for deep value. It was a general rule of thumb when screening for these types of stocks to exclude certain industries and countries like China. My approach toward biopharma and biotech changed after OpenAI released it’s artificial intelligence LLM (large language model) GPT-3.5 to the public in late 2022.

Since then, more companies like Meta, Anthropic and Google have come out with competitive models to OpenAI’s GPT-4. LLMs continue to improve with increased scale even today. The leadership at these companies this year are saying they see scaling up in compute to continue to improve the models for the foreseeable future. This paints a very bullish outlook for industries that are incorporating them.

Some of the industries that benefit the most from LLMs are the pharmaceutical and biotech industry. This is because LLMs store vast amounts of data and find patterns.

Accelerating the Initial Stages of Research:

Drug research begins with identifying disease targets and potential compounds. LLMs can rapidly sift through vast scientific literature, identifying promising targets and overlooked compounds. By automating this review process, researchers can focus on the most promising leads from the outset.

Enhancing Compound Design and Optimization:

LLMs analyze data from various sources, including published studies, clinical trial results, and proprietary research databases. They generate novel compound structures likely to interact effectively with specific disease targets. Additionally, LLMs predict pharmacokinetic and pharmacodynamic properties, guiding optimization efforts to improve efficacy and reduce side effects.

Streamlining Clinical Trials:

Clinical trials are critical but challenging. LLMs analyze historical clinical trial data to predict effective trial designs, identify patient populations, and anticipate execution challenges. This accelerates the trial process and increases its likelihood of success by ensuring precise and effective designs.

Navigating Regulatory and Ethical Landscapes:

Regulatory approval for new drugs is stringent and complex. LLMs assist by analyzing regulatory documents, guidelines, and precedents, helping companies navigate the approval process more smoothly. Moreover, they ensure that research and clinical trials are conducted ethically and responsibly.

The Future of Drug Research with LLMs:

As LLMs continue to advance, their integration into drug discovery promises to be even more profound. Their ability to learn from new information will not only streamline existing processes but also unlock new pathways for discovery. From identifying novel drug targets to predicting clinical trial outcomes, LLMs have vast untapped potential.

With the backdrop of acceleration via LLMs industry-wide companies involved in the hardware and research should do well. Seer is such a company. We saw last year how Standard BioTools ticker (LAB) bought my protein biomarker discovery and clinical diagnostics company pick last year. Of course there is no guarantee Seer will have the same fate. There is, however, the similarity of the company trading below net cash and involved in proteins.

The company I want to highlight today is Seer (SEER). It is a life sciences company developing products that open a gateway to the proteome. They sell a platform for proteomics. Seer’s Proteograph Product Suite is an integrated solution that includes proprietary engineered nanoparticles, consumables, automation instrumentation and software to perform deep, unbiased proteomic analysis at scale in a matter of hours. Seer designed the Proteograph workflow to be efficient and easy to use, leveraging widely adopted laboratory instrumentation to provide a decentralized solution that can be incorporated by nearly any lab.

Here are the basics of proteomic analysis by Seer

Proteomics is like a puzzle-solving game, but instead of puzzle pieces, you’re dealing with proteins.

Proteins are essential molecules in our bodies—they do all sorts of jobs, from building tissues to fighting infections.

Seer, Inc. focuses on understanding proteins better.

They use a special toolkit called the Proteograph Product Suite.

Think of it as a super-powered microscope that looks at proteins in incredible detail.

By studying proteins, scientists can learn about diseases and find new medicines.

Market Outlook

The global proteomics market has been growing steadily. In 2022, it was valued at $22.4 billion, and according to one source is anticipated to reach $100 billion by 2031 with a CAGR of 16.5%. The report with the lowest estimated CAGR up until 2027 was 11.8%. Another report suggests that the instruments and software market within proteomics is expected to grow at a CAGR of 13% from 2022 to 2027. The research I read points toward Asia being one of the more promising markets due to the governments fostering initiatives. They are targeting Asia along with Europe, U.K. and the U.S.

Here are some highlights from the annual report I found pertinent to the analysis.

Since we were incorporated in 2017, we have devoted substantially all of our resources to research and development activities…and running the company (paraphrased)

We expect a highly efficient sales model because our workflow integrates with most existing proteomics laboratories’ workflows and also complements large-scale genomics research.

Valuation

The stock is a deep value and is selling for 50% of it’s net cash and investments. The company has $308.6 million in cash and investments. Fair value of cash and investments is $357 mil. Total current assets are $324 mil and total liabilities are $38 mil.

Current ratio is 8.4

$54.3 million is in cash.

$170.5 mil is in U.S. Treasuries

$110.3 mil in corporate debt securities

$16.7 mil is in commercial paper

$7.1 mil is in U.S. non treasury securities

Seer has $4.43 a share in net cash and investments and as of May 9th traded at $2.23 per share.

Revenue and Earnings

Seer had +38% Revenue CAGR over the last 3 years. For 2024 revenue was forecasted to grow 14% this year, however, this quarter it was revised to flat growth or $16-$18 mil range. The company is not free cash flow positive and reported a net loss per share the last 4 years. The company has burned cash for many quarters but anticipates enough cash to finance operations for the year at minimum. In Q1 ‘24 one customer represented 31% of revenue.

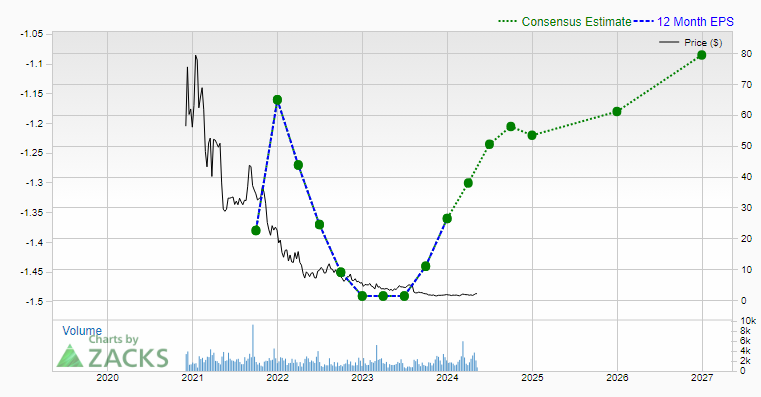

Earnings trend is up the second half of ‘23 and guidance is up as earnings loss is narrowing -see below-

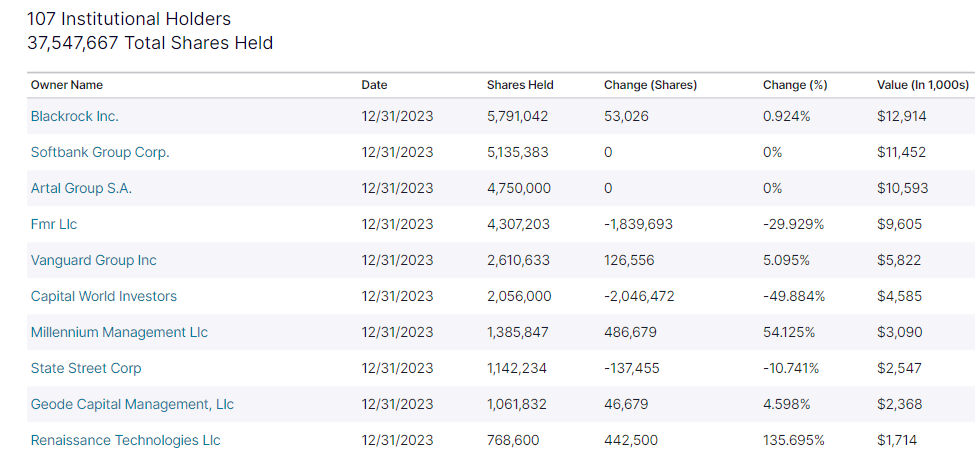

Institutional Ownership

Approximately 61% of the companies shares are held by institutions. The top holders are prominent firms and funds. Here is list of the top holders from highest to lowest. Blackrock holds the most stock. Softbank, Vanguard Group, State Street also hold shares.

The CEO bought 40,000 shares on the open market In August 2023 after the stock crashed -48% that month following an earnings report.

Performance and Technical Analysis

SEER is up +29% YTD vs SPDR S&P Biotech ETF down -$.20 YTD and Russell 2000 index down -2%

The stock has found support at around $1.50 per share multiple times since last year. It’s been in an uptrend since the Feb. support level held. The stock had some unusually high buying volume come in April. It has momentum now breaking over a previous resistance level in early March of $2.18. This is a technical bottom.

I find this stock to be a good buy for a diversified portfolio. I’m bullish on the industry. The stock is trading for far less than liquidation value so I see a margin of safety as a deep value stock.

Disclosure: I don’t own any shares when this is published. I may buy in the future.