In this article, I am going to present the reasons I believe that deep value investing is one of the superior strategies for investing. It can be especially for individual investors like ourselves. This belief I hold is based on tremendous empirical evidence from studies across the globe since the 1930s. The evidence shows that portfolios of deep value stocks actually beat market returns. In many decades, it even beats the index by a wide margin.

Deep value investing in essence is buying shares of a company that is trading on the stock market for less than the value of the assets on the company’s balance sheet. These companies may even be trading for less than the company’s liquidation value.

I got started investing in mutual funds when I was a teenager in the mid 1990s. After my small portfolio of $800 or so crashed in the dot-com crash in 2000 I started asking questions. I started to self-teach myself the basics of investing and stock analysis. That search led me to famous investor Warren Buffett. I read many books on Buffett’s approach. This in-turn led me to his mentor Benjamin Graham who is considered by many the father of value investing.

Early History of Deep Value

Ben Graham started his investment company in 1926 with Jerome Newman. In the 1930s, after the 1929 major stock market crash, Graham found many stocks selling below their net current asset value. This was due to poor earnings during the Great Depression driving stock prices down.

Graham and his colleague at Columbia University Dodd found that stocks trading below a company’s net current asset level also known as “net-nets” were effectively trading below the company’s liquidating value. Assuming conservatively stated working capital, most companies could be sold for at least the value of these assets. They also believed that the remaining assets—plant, property, equipment, and other miscellaneous assets would cover any “shrinkage” in current assets when converted to cash.

By using net current assets as a proxy for liquidating value, Graham established a relationship between the market price of a stock and the realizable value of a company’s assets. Graham bought companies trading well below their liquidating values in bulk also known as diversifying. Graham advocated for holding as many as 30 stocks trading for less than 66% of NCAV at a time. Their net-net portfolio from 1930 to 1956 averaged 20% annual returns.

His most famous student, Warren Buffett, in the early years of his own investment partnership, deployed deep value as one of his strategies. He returned average annual returns of 31% from 1957 to 1968. Other Graham students like Walter Schloss had 21% annual returns over 28 years.

While it is important to look at the beginnings of this strategy with Graham and his students, the real overwhelming evidence comes from broader studies.

Further Study

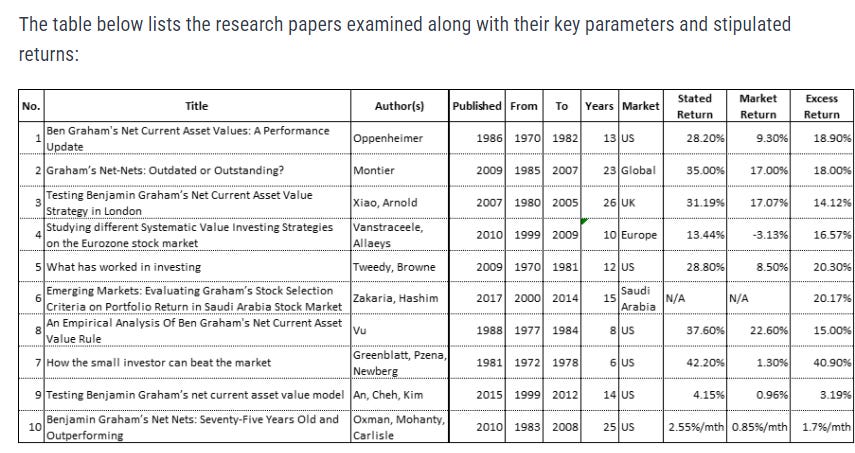

Below are some of the more widely known studies on net current asset stocks.

In one study, Victor J. Wendl, president of Wendl Financial, published a book, "The Net Current Asset Value Approach To Stock Investing," where he analyzed how the net current asset value method performed over 60 years from 1951 to 2009. Stocks were included in the portfolio if the trading price was below 75% of the net current asset value calculation. Stocks were held between one and five years.

The net current asset value portfolio returned 19.89% beating both the S&P 500 index return of 10.67% and Wilshire Small-Cap index (return 11.20%) by a wide margin. The study showed that the more undervalued a stock was relative to its net current asset value, the higher the future return.

Japanese Study

In the first study outside of the United States, Bildersee, Cheh and Zutshi tested the strategy in the Japanese market from April 1975 to March 1988. The study was published in Japan and the World Economy in 1993, entitled "The Performance of Japanese Stocks in Relation Their Net Current Asset Values."

To keep a sample large enough for cross-sectional analysis, Graham's criterion was relaxed so that companies are required to merely have a net current asset value-market value ratio greater than zero. The study's net current asset value portfolio returned 20.55% and the market index returned 16.63% annually over the same period.

Large Global Study

James Montier examined the performance of net-net stocks on a global basis. He purchased a portfolio of net-net stocks in all developed markets globally over the period of 1985 to 2007. The returns were incredibly strong. An equally weighted basket of net-nets generated outstanding average returns of 35% per year versus market returns of 17% per year! The net current asset value strategy worked well at the global level. Within regions, these stocks outperformed the market by 18% in the U.S., 15% in Japan and 6% in Europe.

London Study

Ying Xiao and Glen C. Arnold from Salford Business School studied net-nets in London from January 1980 to December 2005. Portfolios were formed annually in July, including stocks at two-thirds of NCAV. Holding periods ranged from one to five years, with returns significantly outperforming the market:

1 year: 31.19% vs. market’s 20.51%

2 years: 75.11%

3 years: 126.27%

4 years: 191.62%

5 years: 254.02%

Investing £1 million in NCAV portfolios in 1981 would have grown to £ 432 million by 2005, compared to just £ 34 million in the entire U.K. market. This highlights how buy and hold can work with the NCAV strategy.

Small-Cap Value Wins Again!

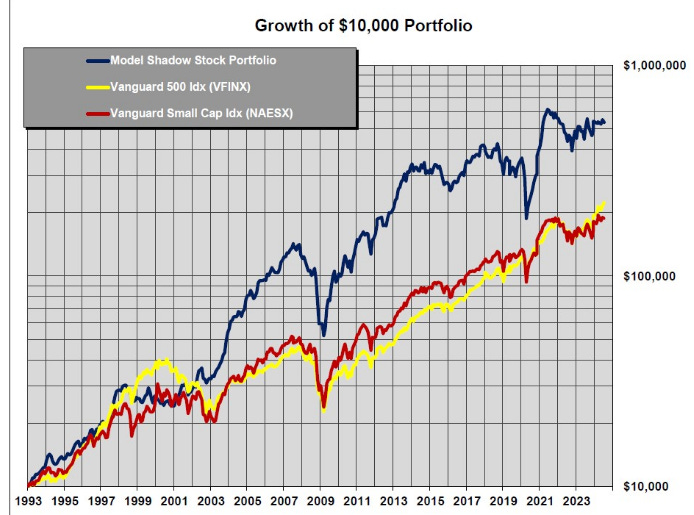

One of the more interesting and convincing value stock returns is from the American Association of Individual Investors AAII Model Portfolio and their model shadow stock portfolio. This portfolio’s focus is on stocks trading at a discount to book value.

The portfolio is managed by strict criteria including a market cap of $30 million to $300 million. The stocks must sell for less than or equal to .90 of price-to-book value. There are other very strict criteria and triggers to buy and sell stocks in the portfolio. Interestingly, momentum is used as a tiebreaker among qualifying stocks. A ranking on four-week relative strength is used as the tie breaker.

Since the AAII model portfolio inception in 1993 it has averaged an annual return of 13.5% vs 10.4% on the Vanguard 500(S&P 500 tracker) and 9.7% on Vanguard Small-cap index. The cumulative growth is even more impressive! This model portfolio on a $10,000 investment turned into $536,000 vs just $223,000 in the Vanguard 500 a Standard and Poor’s 500 tracker. The S&P 500 index is the main benchmark for U.S. stock investors. It is considered “the stock market.”

Is This Making Sense Now?

I hope you are starting to see what I see in the historical evidence. The evidence is clear that deep value investing works for individual investors. The Tweedy Browne studies also looked at low price-to-book value. So, the stocks don’t always have to be below net current asset value to be big winners. This is why I also look at net tangible asset value.

My Own Thoughts On Why Deep Value Works So Well

A good investing or trading strategy should be repeatable and methodical. This strategy works because at the crux of it is a focus solely on the tangible assets on the balance sheet. This gives us simple clear criteria. This is less nuanced than many other valuation methods and investing strategies. By virtue, intrinsic value with my deep value strategy is easier to calculate and is more reliable.

There is also a contrarian aspect to buying stocks so cheap. It goes back to the old adage in stocks of buy low, sell high. Or as Buffett would put it, “Be fearful when others are greedy, and be greedy when others are fearful." Graham in his book The Intelligent Investor describes the fluctuations as the changing persona of Mr. Market.

My Approach

I put my own flavor on my deep value approach from 20+ years of investing experience. Most of the time I am bottom up. Meaning I get my stock ideas from stock screeners that find strong balance sheets. I use net cash, net current asset value and net tangible asset value as my main quantitative criteria. I like to see multiple quarters or years of relatively stable cash levels if cash is a high percentage of net current asset value.

I look at all the fundamentals like growth, profitability and valuations. I also know from all my years of looking at deep value which ones are in an industry that give them a higher chance of performing well. A strong brand name is helpful too.

I also look to see how shareholder oriented the management is. Ideally, you will see shares outstanding stable or decreasing from buybacks. I notice dividends, growing shareholder equity. Of course, the nature of some industries and hardships of small-cap companies which these companies tend to be can muddy the waters on those sometimes.

The times I am more top-down in finding companies it is by focusing on industry. Sometimes there is obvious sector or industry rotation going on or coming in the market. I do this by looking at dozens of technical stock scans nightly on stocks under $12. All that said, I take every angle I can in my fundamental approach.

In my selection, I stress deep value or being at least near net tangible asset value. I have seen instances of large quality companies trading just above net tangible asset value like Caribou Coffee (bought out by private equity) in 2009-2010 and American Axle & Manufacturing Holdings (AXL) around the same time after the great recession in 2008.

I believe having lots of strict criteria and rules in selecting these stocks can be an obstacle in the selection process. It makes it possible to miss good ones. So, I prefer to use my own judgement based on my years of experience following these types of stocks.

Welcome New Subscribers!

I’m glad to have you onboard. Check out my past blogging on other websites and my social media and videos on X/Twitter here https://linktr.ee/stockpursuit

This Substack is only focused on deep value stocks and very occasionally other small-cap companies I see turning around or at a value. As my support grows I may be able to include going private transactions and liquidations into my content. If you get “value” from my posts—no pun intended—consider upgrading to a paid subscription.

Sources For Further Reading On Deep Value

https://www.nasdaq.com/articles/testing-grahams-net-current-asset-value-strategy-part-1-2017-03-02

https://alphaarchitect.com/2021/01/ben-grahams-net-current-asset-value-net-net-strategy/

This is one of the most comprehensive posts on the data behind deep value investing I have seen. Great read!