Thematic Net-Net Revisited

The data center electrification theme is continuing strong

I did a write-up last year on some alternative power stocks here.

My interest in the stocks was because they fit into the clean energy thematic, and were deep values.

The thesis here today with Fuelcell (FCEL) is the same. The difference this year is, the Hyperscaler’s are broadening more to fuel cells. AI inference, and the coming wave of AI agents need more and more data centers. The trend is clean power these days. Nuclear power takes a long time to get up and running, and SMRs are not filling the gap yet. Some natural gas turbines are on backorder.

Fuel cells are one of the fastest deployable power options for new or expanding data center projects right now. They offer time-to-power advantages that are 4–8 times faster than traditional onsite solutions.

The fuel cell for data center market is projected to reach $759.85 million by 2034, growing at 15.6% CAGR. FuelCell Energy is well-positioned as the fuel cell market specifically targets IT and cloud services segments.

I’ve been following the big data center news closely. The data center growth is as strong as ever today. There is Oracle’s (ORCL) blowout quarter yesterday on cloud growth and forecasted growth. Data center builder Fermi has an IPO coming. Its flagship “Project Matador” in Amarillo, TX aims to deliver up to 11 GW of power for energy intensive AI. 11 GW is double the current largest 5 GW planned development.

I believe the stage is set here for Fuelcell to follow in Bloom Energy’s path. Fuel cell company Bloom Energy (BE) has had a tremendous year, up 460% over the past year. The driver has been big data center contracts from American Electric Power, Equinix and recently Oracle.

I've been covering Bloom Energy on my X/Twitter account since 2024. The market took awhile to catch on to it even as they were an obvious choice for future data centers and even hyperscalers with the AI boom accelerating.

I find it interesting that before the recent big American deals, Bloom was getting a S. Korea deal. This below on Bloom is from me in 2024.

Fuelcell just got their big S. Korean deal this quarter.

Another thing. This Fuelcell conference call yesterday reminds me of a Bloom Energy conference call before the big Oracle deal where the Bloom Energy CEO clearly hinted at more data center business coming. "Data center" must have been said 40 times or more in the Fuelcell call yesterday.

Here are some of the significant catalysts from the conference call.

U.S. legislative support, including reinstatement of the investment tax credit (ITC) and the 45Q carbon capture incentive, positions FuelCell Energy favorably for growth.

FuelCell Energy and Inuverse signed a Memorandum of Understanding (MOU) in July 2025 to develop large-scale clean power solutions for AI and hyperscale data centers in South Korea, with a goal of deploying up to 100 megawatts (MW) of fuel cell-based energy at the upcoming AI Daegu Data Center (AI DDC) starting in 2027.

Here's a big nugget from the Fuelcell conference call today: "We are in conversations with leading data center developers, hyperscalers and investors about how our platforms can meet their rising demand for reliable, clean baseload power."

Financials

They are targeting positive EBIDTA soon, when annual production reaches 100 MW at the Torrington facility. Revenue in this recent quarter was up 97% year over year. They did report a net loss.

Net current asset value is $211 million and the current market cap is just $187 with the stock at $5.80. They have $236 mil in cash. So, we have a true net-net here, participating in the power generation for one of the biggest growth themes data centers.

Plug Power (PLUG) is another low market cap stock working with hyperscaler’s.

Plug Power is actively developing hydrogen fuel cell solutions for data center backup and primary power, offering a zero-emission alternative to traditional diesel generators for critical infrastructure. The company has demonstrated its capabilities with a high-profile collaboration, such as building a 3MW hydrogen fuel cell system for Microsoft's data center, which is seen as a significant milestone for the industry.

Data Center Applications

Plug Power's GenSure stationary fuel cells provide scalable, zero-emission backup power tailored for data centers of any size, from edge to hyperscale facilities.

Technical Analysis

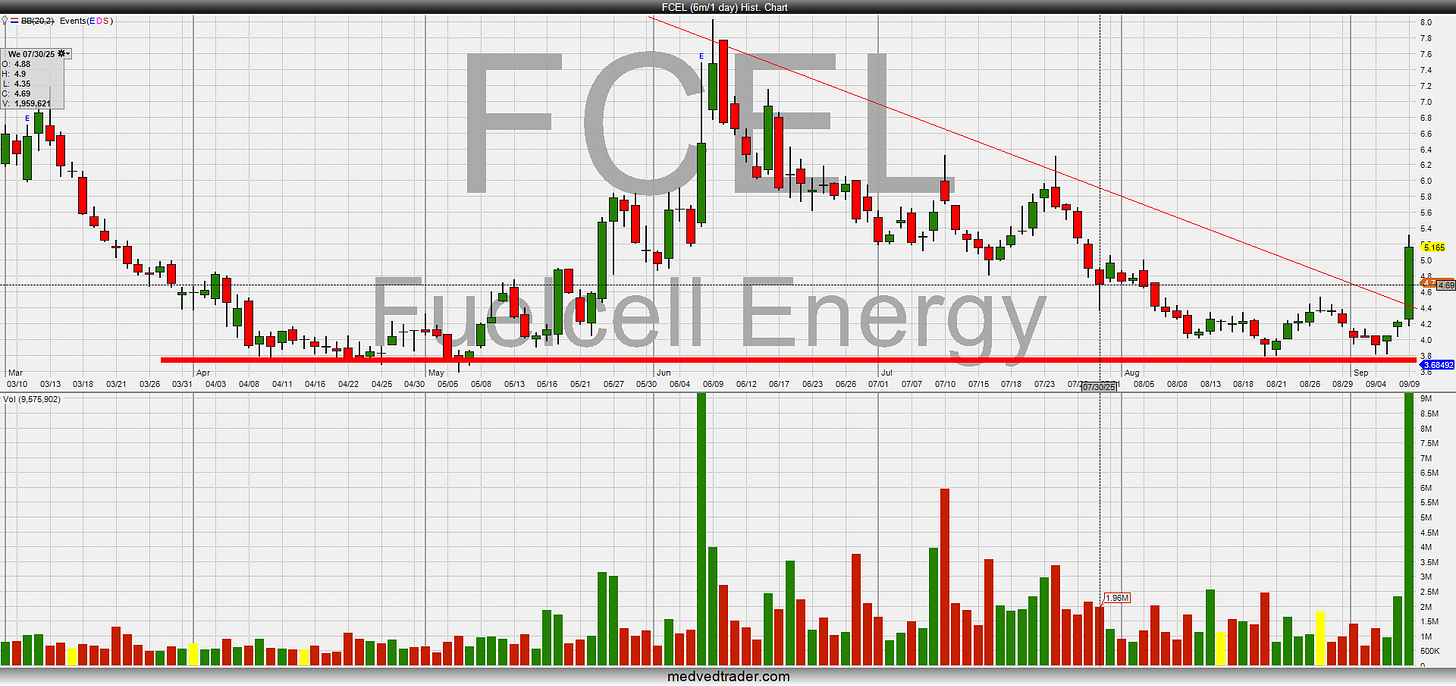

Fuelcell’s chart found a support level and broke its downtrend momentum yesterday off the earnings day. It’s set up for a technical bottom.

Full Disclosure: I’m long FCEL stock and call options. Also long PLUG stock and call options.

Excellent idea, thanks for sharing. Net net with great possible tailwinds.

How good do you think their tech really is when compared to BE? I keep hearing their tech is subpar. INterested on having a conversation about it.