Famous value investor Benjamin Graham wrote a book called The Intelligent Investor that many consider the genesis of value investing. In the book, he talks about Mr. Market. Mr. Market represents the bi-polar extremes of the stock market. Sometimes he will underpay for a stock; Sometimes he will be manic and overpay. A smart investor knows the value of the companies they invest in. They look to take advantage of the extremes.

When I look at these growing or fundamentally sound deep value stocks trading at or under their cash and assets, I know the market could generally care less about them. Sometimes the company’s turn things around themselves and get attention. Sometimes industry trends improve and reward these companies.

The current market environment has been rewarding many small-cap companies lately through industry rotations. One such company is my deep value selection Palladyne AI (formerly Sarcos) from May of last year. They changed their name from Sarcos. Palladyne was in deep value territory trading 28% below net current asset value. It had incredible sales growth too.

Last year, I had a very strong opinion based on research and being an early adopter of LLMs that the AI and robotics theme was going to be very big. We’ve seen companies like Palantir (PLTR), Red Cat (RCAT), AeroVironment (AVAV) which use AI for analytics and other military AI applications like drones, greatly rewarded in the current market environment.

The market didn’t care for Palladyne AI and other AI small-caps like Big Bear AI (BBAI) last year. It took a recent Army contract for Red Cat and this partnership announcement with Palladyne. Palladyne makes the AI software that Red Cat uses in their Teal drones.

Palladyne PDYN is now up 350% in just the last three months!!

The amusing thing is this partnership announcement is old news from early October. Big blocks of shares were bought October 8th, but buyers backed off until three days ago. One of the many benefits of investing in these smaller stocks is the time it takes for the market to react to news. I’ve also seen many great quarterly earnings reports go seemingly unnoticed for days.

Big Bear AI (BBAI) is another AI defense one I have on a watchlist and am trading long call options on. It’s far from a deep value or Palantir type company, but it’s the best second order AI defense small, micro-cap I know of other than Palladyne and Red Cat. Big Bear’s balance sheet is ok. It’s another stock in the AI defense theme.

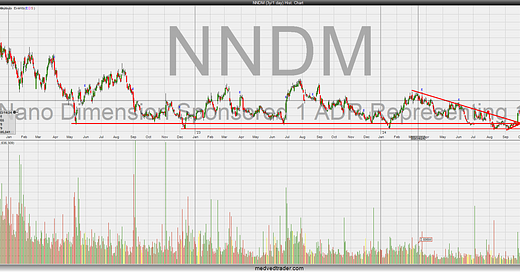

Nano Dimension (NNDM) is another deep value I’ve had on a watchlist. It continues to trade near its net cash level. After the recent purchases of Markforged and Desktop Metal, net cash and equivalents, back of the envelope is $420 million and the company is trading for $480 million at $2.16 a share.

The company offers 3D printers, including:

AME systems: Inkjet printers that produce Hi-PEDs by depositing special conductive and insulating substances. These printers can also integrate components like capacitors, antennas, coils, transformers, and electromechanical parts.

Micro additive manufacturing systems: Digital light processing (DLP) printers that create high-quality polymer and composite parts.

Industrial additive manufacturing systems: Uses a special foil system to make ceramic and metal parts.

They also provide robotics and control systems for additive electronics, which include:

Surface-mount technology (SMT): Equipment used to assemble electronic components on Hi-PEDs and printed circuit boards (PCBs).

The stock continues to find a floor at the low $2.00 a share level.