Grab a cup of coffee or tea, I ended up doing a deep-dive on this one.

The sentiment on the cannabis industry has been incredibly low for some time. Rightfully so, new industries are challenging with fierce competition. However, there can be opportunistic spots to invest in any industry from time to time. Especially from the deep value standpoint of buying extremely cheap and being tactical.

The opportunity here in net-net Cronos Group (CRON) is along the lines of an old write-up I did here on Imperial Petroleum (IMPP) in October of 2023. I didn't like the industry particularly, but there was an industry rotation opportunity I managed to catch the bottom on among some other signals. Imperial had a history of revenue growth and some positive EPS being a couple of those. IMPP went on to more than double shortly thereafter in 2024.

I’m less certain on an immediate industry rotation in cannabis. There could be some near-term catalysts I talk about at the end though. There have been a lot of cycles in the past in this industry and they may be so beaten down now it finally comes again.

Turnaround Underway

From a bottom-up standpoint there is a lot to like with Cronos (CRON). They are in the midst of a turnaround that is continuing to materialize since CEO Mike came back in 2022. Since current CEO Mike Gorenstein came back, operations have steadily improved. They went from negative gross margins in 2021 to high 30% and most recently 40%. In 2023 they cut the lower margin United States hemp CBD segment. Mike refocused the company on core brands and high margin products.

Some other things going for them are being mostly vertically integrated. They are becoming even more vertical with the new facility expansion.

Cronos Group has a lot of good things going for it. For starters they have the best balance sheet in their industry and Altria (MO) has a 41% stake in them. There are a couple Altria people currently on Cronos’ board of directors. In 2019 Altria invested $1.8 billion USD into Cronos.

Brief Overview

Cronos Group had its beginnings as a Canadian medical cannabis company called PharmaCan Capital in 2012. The name changed to Cronos in 2016, the same year Mike Gorenstein became CEO. They sell cannabis products in the consumer market and the medical market. They sell in Canada, Israel, and internationally. Let's jump into their most recent quarter.

Their brand Peace Naturals® retained its position as the number one medical cannabis brand in Israel. Israel is a big market for them, and 30% of Cronos' sales came from Israel. Sales in Israel were up 40% YoY. They just started selling Peace Naturals in Switzerland this year. It is also in their other international markets.

● Spinach® brand is a top brand in Canada, with rankings in the #1 position in flowers and top 4 in other categories. They are top-ten in pre-rolls.

● SOURZ by Spinach® is expanding with new launches. SOURZ by Spinach® products are the best-selling gummies in Canada and have captured an impressive 20% market share in Q1 2025.

● The Lord Jones brand is the category leader in the hash infused pre roll segment with a big 30% market share.

In 2024, they had two major customers, Ontario Cannabis Retail Corporation at 32% of sales and Alberta Gaming, Liquor and Cannabis Commission at approximately 17%.

Here’s where it gets interesting…

Financial Highlights - Balance Sheet

Cronos has the strongest balance sheet in the industry, with no debt and cash equivalents and short-term investments of $838 mil.

Net current asset value (NCAV) is $879.5 million. Their cash pile stands at an unmatched $797 million. The current market cap with the stock at $2.04 is $782 million which is less than cash and at a 11% discount to NCAV. Current ratio is 27.

There hasn’t been any major dilution the last few years. In 2021 shares outstanding was 370 million and today there are 385 million. This is a stark contrast to the other Canadian cannabis companies.

Income Statement

Four year revenue CAGR is 26%. In the most recent quarter revenue grew 28%. They grew revenue 35% YoY for the full year of 2024.

TTM EPS is positive at $.03. In CRON’s last quarter they beat EPS estimates by 100% with EPS of $.02. They beat estimates in the previous two quarters also. Earnings surprises can often be a signal for a lasting sentiment momentum switch. This trend is way better than the largest competition who are still struggling with turning positive quarters.

Gross Margin Improvements

Gross margin expanded big-time this last quarter to 43% from 18% YoY. This was from improved product mix, reduced expenses, sales and price increases and some timing benefits. They are expecting the rest of '25 to have gross margins with a blend of Q4 last year and with the 43%. Q4 2024 gross margin was 36% and adjusted for GrowCo expense was 30%. The full year 2024 gross margin was 21% and full year 2023 13.6%. So, it’s just been robust steady improvement.

My research on the top Canadian players is gross margin is the best at Aurora with a 60% range and their medical at 70%. Tilray has been running 30% and Canopy in past years was below 20% but is now about 30% too. Organigram is targeting full year ‘25 at 35%. So, Cronos is running higher than everyone except Aurora. There is potential for even more gross margin expansion with Cronos from Canadian tax reform underway that I touch on later in my final thoughts and catalysts.

Cash Flow

In full year ‘23 and ‘24 free cash flow was positive. In 2024 they had $18 million in cash from operations.

Uncertainty

Some potential negatives are Israel has recently threatened to add a tariff of 65% on their medical cannabis products brought into the country. The proposed tariffs were opposed by the Ministry of Health and the Competition Authority, and on April 25 were vetoed by Israel’s Minister Of Finance. The Minister of Economy has said regardless he will still be moving forward with them but it is in dispute.

If the Canadian tax reform goes through it would offset this tariff some. In Q1 2025, Cronos reported $9.6 million in federal excise taxes. But there would still be an Israel tax burden of $4 million net.

Share Buybacks

On May 7 2025, the Board of Directors authorized a share repurchase of up to $50 million or 5% of shares outstanding. It started on May 14 2025 and ends May 13 2026. The interesting thing here is this is the first ever buyback in company history.

Expansion Underway

In 2023 they started investing in cultivation facility GrowCo to expand the supply chain. They now own 50% of GrowCo and have a four year option to purchase up to 80% of it. GrowCo has had strong operations and positive free cash flow. Cronos capex has been elevated as they are expanding GrowCo but capex is expected to normalize after the second half of this year. Additionally, they are looking to bring more from GrowCo online the rest of the year to combat supply constraints. They have actually had some supply issues to meet demand. That's really the only negative thing I noticed going on with them lately.

The GrowCo facility in Kingsville, Ontario is expected to start to bring in revenue in Q2 this year. The upside seems intriguing with them having a current revenue run rate of $129 mil. I couldn't find updated specifics on the exact capacity it will bring but the old communications were it spans 100 acres in total.

I see where the initiative to use the new facility capacity to grow international sales is coming from. From what I have found the only “other” international markets so far are Germany, U.K. Switzerland, Malta and Australia. These grew a whopping 385% YoY for 2024. They are particularly bullish on their Germany and U.K future growth.

They see promise in the U.S. market long-term and plan to enter it when federal laws accommodate. Their largest investor Altria shares the same perspective. Altria has said they are for federal legalization of cannabis. They are lobbying at the federal and state level for CBD and cannabis. They have also filed a patent for a THC vape.

Insititutional Ownership

The largest institutional holder is Chescapmanager LLC who manage just under $1 billion and have a style of a blend of macro hedging and growth. Their top holdings are large tech stocks.

Another top holder is hedge fund Cannell Capital LLC. Apparently they are known as an activist hedge fund. They are long/short with interest in mispriced small-caps. So, I've got some company here in my approach to this one. Another top holder is Quinn Opportunity Partners LLC a value-oriented hedge fund. This is the same value angle here too.

Recent Conference Call

The only analyst asking questions on the conference call asked if the product shortages were industry wide or Cronos. The answer was they are seeing shortages of good product in the market. They said this is why they are investing in GrowCo.

Technical Analysis

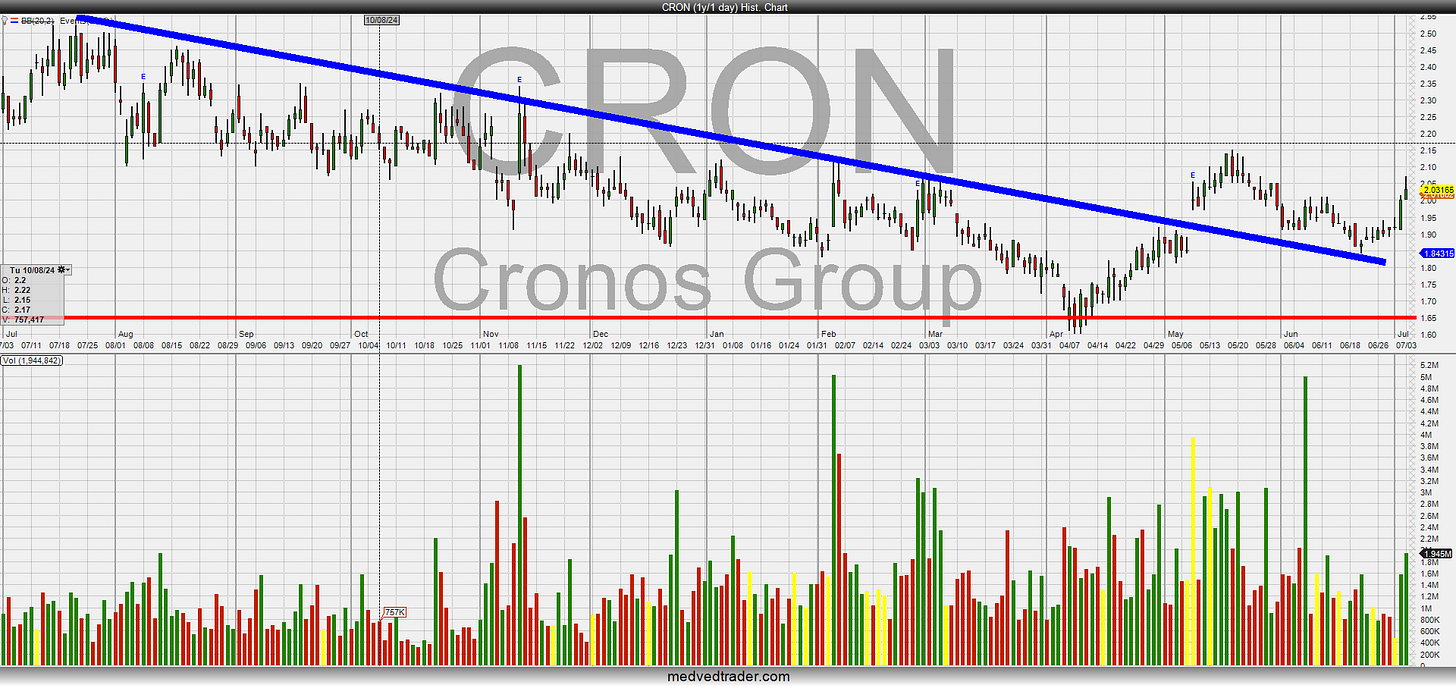

The last quarterly report sent a positive reaction in the stock price. It consolidated down to $1.84 and is now back to the same price the day of the good quarter. The $1.66 area has been the price floor since 2023. Even in the tariff turmoil this April the price didn’t go much below that. In the summer of 2023 NCAV was $893 mil and the market cap at $1.66 was around $630 mil.

The thing that really caught my eye was this downtrend momentum change you can see as the blue down channel resistance got breached. I think the retest hold was June 23rd and this current move is off a bull flag and we will make a technical bottom now. You can see the same bull flag really well in industry competitor Village Farms (VFF) too.

Possible Positive Industry Catalysts

From my perspective as an active trader I have seen pretty relentless short pressure on the cannabis stocks over the years. The biggest bullish rotations would get subsequent major bear raids. To speculate on industry catalysts there could be degrossing at shops at some point that give these highly shorted cannabis companies a boost and in-turn move the whole industry.

Canada is actively moving toward cannabis excise tax reform. There is a strong push from industry groups like the Cannabis Council of Canada and reports from Deloitte urging the government to eliminate the $1 per gram minimum tax floor and move to a uniform 10% rate. Industry studies and reports suggest that shifting the excise tax to a flat 10% of sales (removing the $1 per gram minimum) would reduce the effective tax rate by roughly half, which could translate into gross margin improvements of 10 to 15 percentage points or more for many producers.

Cronos reported $9.6 million in federal excise taxes on $41.9 million in sales in Q1 2025, or a nearly 23% rate. If the 10% flat tax takes effect they would have saved $5.4 million in taxes.

Final Thoughts

They’ve proven they can grow—and not just top-line, but margins, positive earnings and free cash flow. The valuation is cheap being in net-net territory. The cash pile is substantial. The turnaround is measurable. Their biggest publicly traded Canadian competition can’t get profitable.

Given how strong the balance sheet is and the continuing improvements I'm willing to give this one a few quarters at least to see how the GrowCo facility improves sales. Since they have proven they can grow, the upside on this is well worth the risks especially with the stock in NCAV territory flush with cash.

The potential negative drivers on the stock are risks of continued pressure from shorts on the industry and continued weak sentiment. The stocks may be so beaten down a rotation finally comes again. The short interest on Cronos is negligible here but based on historical share price performance paired with the industry they will need overall industry rotation to see the stock price really perform well.

The potential is good with how well they are executing with such a low valuation. I can see a scenario where they outperform the industry. This involves the sustained sales growth with the GrowCo facility help, holding or improving margins further and the share buybacks all combining to really put up a quarter with strong EPS.

Disclosure: I just found this one and have no position at this time. I may buy in the near future.