American Outdoor Brands (AOUT) Near NTAV

Strong Former Smith and Wesson Outdoor Brands Trading Near Net Tangible Assets

It’s been awhile since my last post, so I want to cover some ground here. Some of the stocks I have been writing about are making new yearly highs for the year right now, like Origin Materials (ORGN) and Coffee Holding Co. (JVA). Some are near highs, like Allied Gaming (AGAE).

I've written about Coffee Holding Co. (JVA) many times over the years. I noticed many years ago that net tangible asset value (NTAV) would act as a floor for the stock price. Since my last mention of it, when it was substantially below NTAV with the stock price at $1.47 a share the stock has since run to $3.39 as of today. The board has decided to terminate the merger with Delta Corp. They have swung back into profitability last quarter, reporting $0.11 a share in net income on 19% sales growth year over year.

Jerome Powell and the Federal Reserve just yesterday cut rates .50, thus lowering the fed funds rate. Interest rate sensitive assets have been reacting as investors have clearly been moving into real estate, utilities and fixed income. Exchange traded funds (ETFs) like tickers IYR, XLU, IAGG and just recently, XHB, have seen steady flows.

Lots of small-cap companies carry a lot of debt, so we may finally see some broad rotation into small-caps. The i-Shares Russell 3000 index ETF (IWV) just made a new yearly high today. The Russell 2000 has been lagging, as it has for a long time; however, it is near the yearly highs.

The Value Stock

The company I want to highlight today is a very small company. They have some great brands, though. Over the years some of the best deep value stocks I saw had strong brand names.

In August of 2020 Smith and Wesson (SWBI) the firearm manufacturer spun off many of their brands. American Outdoor Brands (AOUT) is the spin-off company that trades on the NASDAQ.

The thing that drew my attention to American Outdoor Brands was the strong long-standing brands they own. I’m not the biggest outdoor enthusiast, but I have done some fishing and had some knifes over the years. I immediately recognized the BUBBA, Old Timer and Schrade brands. They have lots of other great brands too, especially in the shooting category.

I want to just list some of the brands here so you can get an idea. Accumax®, BOG®, BUBBA®, Caldwell®, Deadshot®, Deathgrip®, Delta Series®, Don’t Be Outdoorsy – Be Outdoors®, E-MAX®, Engineered for the Unknown®, F.A.T. Wrench®, Fieldpod®, Frankford Arsenal®, Golden Rod®, Hooyman®, Imperial®, Intellidropper®, Lead Sled®, Lockdown®, Lockdown Puck®, Mag Charger®, MEAT! Your Maker®, Old Timer®, Schrade®, Sharpfinger®, Tipton®, Grilla®, Grilla Grills®, Uncle Henry®, Unmatched Accuracy at the Bench and in the Field®, ust®, Wheeler®, XLA Bipod®, Your Land. Your Legacy®, Crimson Trace®, Lasergrips®, Laserguard®, LaserLyte®, Lasersaddle®, Lightguard®, and Rail Master®.

I remember how major firearm manufacturers like Ruger (RGR) and Smith and Wesson have traded over the past couple decades. The stock prices were very volatile and investors were very flighty with the companies. One year like with Ruger they would trade for $10 a share and a few years later up to $60 and down to $40 the next year. That said, there have been many long periods where the market truly has rewarded their fundamentals. So, I would expect similar things with AOUT. Infact, AOUT stock was at a low of $12 in 2020 and ran all the way to $35 in 2021. As I have said, it is always nice to see a beaten down deep value stock that can be a strong performer in the market at points in time.

Valuation

The sentiment is very bearish now, with AOUT trading for just $1 a share over net tangible asset value per share. AOUT’s market cap is currently $116 million, with the stock at $9.05 a share. Net current asset value is $93.3 million and net tangible asset value is $104 million or $8.10 a share. The stock is also trading for around .50 times TTM sales. For the last fiscal year, they grew sales 5.2% year over year. The most recent quarter saw sales decline -4% and a net loss of $0.18 a share. Those estimates beat analyst estimates however and compared to a net loss of $.31 in the prior year. The company is maintaining full year guidance and sales are expected to grow about 5% over the next two years.

Another interesting thing is earnings have surprised to the upside 5 of the last 6 quarters it looks like. B. Riley is a very good shop and they are holding their buy rating. Roth Capital is rating the stock a buy too and have increased their price target from $10.50 to $11.00. They also raised their Q3 earnings to $.12 from $.11. They expect $0.24 in earnings a share for the full year and next years earnings to come in at $0.51.

Some other good things are gross margins have been pretty stable, fluctuating from 44% to 46% the past few years. They maintained 45.4 gross margin this last quarter vs last year.

However, net income has been negative since 2021. For full fiscal year 2024, they had a net loss of $12.2 million, or ($0.94) per diluted share in fiscal 2024 compared to $12.0 million, or ($0.90) per diluted share in fiscal 2023.

They have put up a lot of good quarters and full years of free cash flow though. They have averaged about $10 million in free cash flow a year, though it has had swings quarter to quarter. Cash on the balance sheet is up from a year ago and is at $23.4 million now. The stock trades for 11 times trailing twelve month free cash flow.

They don’t have any long-term debt. They do have a credit facility, which consists of a $75.0 million revolving line of credit. As of this recent quarter, they had no borrowings outstanding under the revolving line of credit.

Share Buybacks

There are more good things. In October of 2023 the board authorized up to $10 million of common stock repurchases through the end of this month. Over the past two years, they have repurchased roughly 1,250,000 shares. They bought back 42,017 shares this past quarter too. They have been buying back shares consistently every year since 2021, when they had over $14 milllion shares outstanding. Today shares outstanding are at $12.8 million. I like this management.

As far as the business goes, in 2024 the shooting sports category sales were $91.7 mil and outdoor lifestyle $109.3 mil. For their last full year brick and mortar traditional sales were $116 mil vs e-commerce with $84mil. Traditional sales channel had 12% growth vs -3% e commerce. Another good thing is international sales have been growing. In the last quarter international sales were up a nice 21%. International sales are currently small at $4.4 mil or just over 10% of sales.

This is a good thing to me because it shows the upside potential is really good here, and if it accelerates, it could add some big positive surprises. As the saying goes, sales can solve a lot of problems.

Technical Analysis

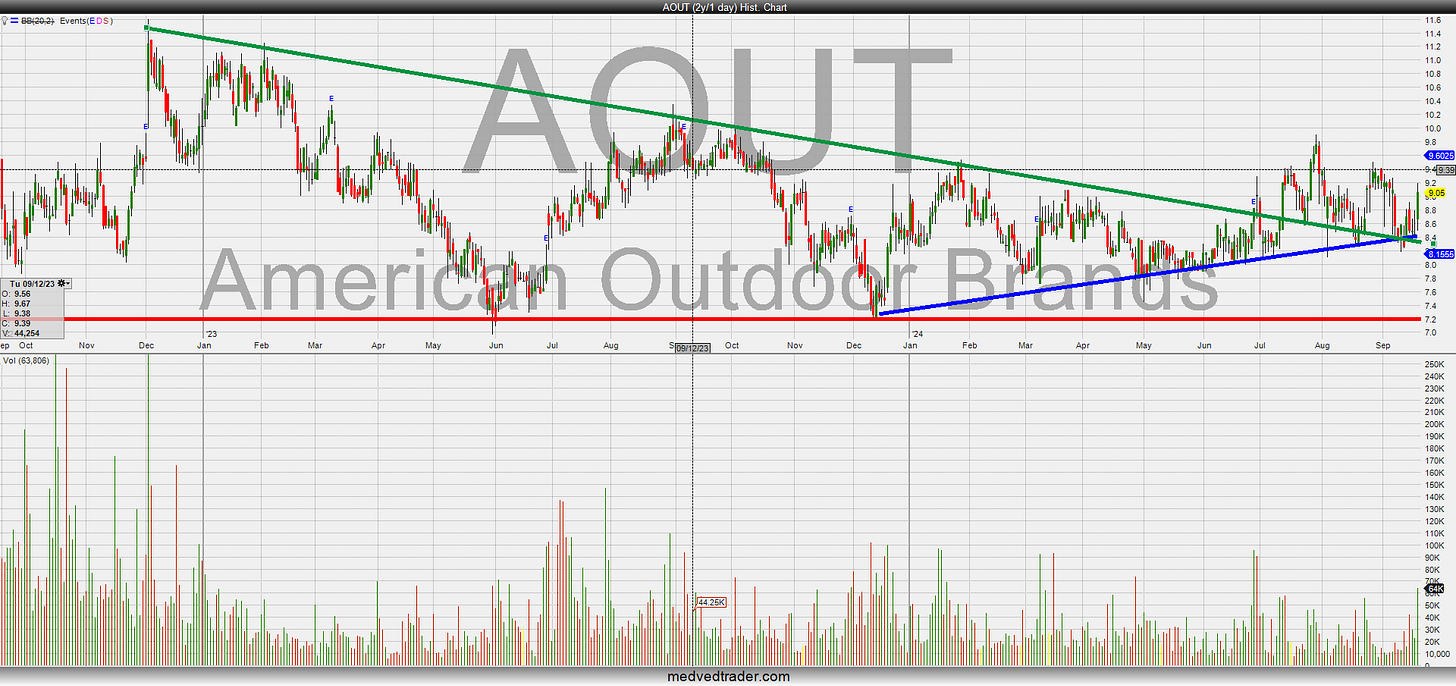

I’m writing this article now because based on the technicals I am not sure it is going to be below NTAV at $8.00 a share anytime soon. The stock has found a lot of support around $7.20 (bottom red line) and recently around $8.00 as it is in a steady uptrend. Trend support is the blue line. You can see momentum is trying to flip to up as the long green line from the 2022 high is being retested and holding multiple times. The stock is at a pivot point here.

Thank you for this wonderful write-up.