Origin Materials ticker symbol ORGN reported quarterly earnings results a couple days ago. They now see revenue over the next couple years rising over 300% up from $25-35 million projected for full year 2024. They signed their first caps and closure customer and the orders are bigger than they anticipated. They are also reaffirming the pathway to profitability.

The stock is up 70% over the past two days following the earnings announcement. Here are some of the highlights from the press release.

Adjusted EBITDA loss was $12.9 million for the second quarter compared to $11.7 million in the prior-year period.

Full Year 2024 Outlook

Based on current business conditions, business trends and other factors, the Company is maintaining the following guidance for 2024 revenue and net cash burn:

Revenue of $25 million to $35 million.

Net cash burn between $55 million and $65 million.

"Today we are announcing our first signed customer for Origin’s PET caps and closures," said Rich Riley, Co-Chief Executive Officer of Origin. "We anticipate delivering multiple billions of caps to this customer over the next several years, which we expect will generate over $100 million in revenue in the initial two-year term, with revenue expected to begin in early 2025, ramping significantly in 2026. Therefore, to fulfill demand for this MOU as well as anticipated demand from other customers, we expect to build capacity well beyond our initial system purchases, which we previously announced as having expected capacity to generate between $45 million and $65 million in annual revenue.”

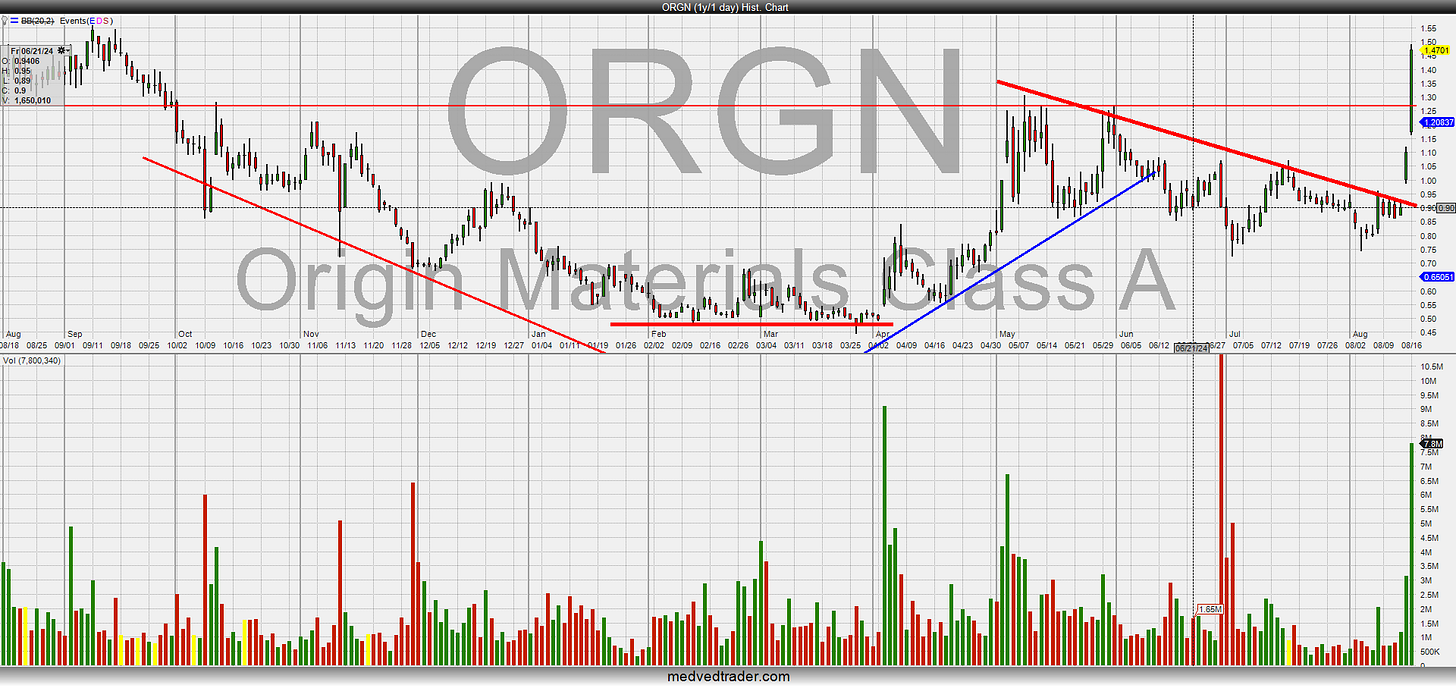

Origin technical analysis is pointing to a confirmed rounding bottom formation.

Jones Soda ticker JSDA also reported earnings recently and I think it was a great quarter. I will do another post on Jones over the next day or two. I really believe this new management from Pepsi is going to do some great things.